California Housing Bond: Empowering Middle-Class Homeownership

Overview: The proposed $25 billion housing bond, slated for voter approval in 2026, provides down payment assistance to buyers of new construction homes who earn less than 200% of California’s median household income (up to ~$193,000). Buyers contribute 3% down, with the state offering a 17% second deed of trust loan (repaid with interest upon sale, refinance, or maturity), and a primary mortgage covering 80%. This structure incurs no cost to taxpayers, as the assistance is a secured loan backed by the property ensuring full repayment to the state. By lowering the entry barrier to homeownership, the program helps middle-class families build equity and stability, with fixed mortgage payments becoming more affordable than rising rents over time. Buyers in all scenarios come out ahead of renters after Year 4. This does not account for potential lower interest rates once program is introduced.

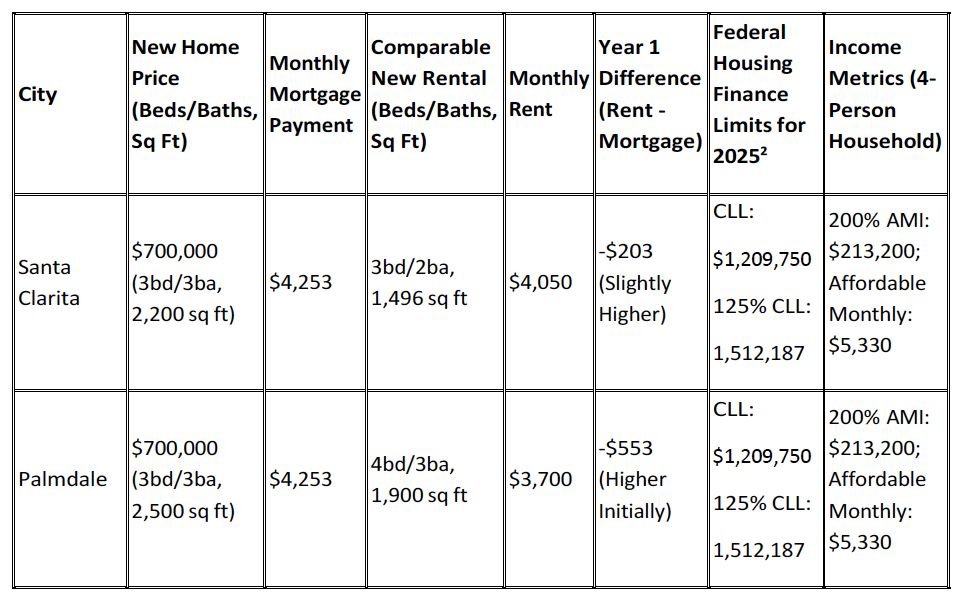

City Examples (3-Bedroom New Construction Comparisons): Assumptions include 7% combined mortgage rate over 30 years1; total monthly payments (principal + interest on both loans); comparable rentals based on size/beds/baths. Rents may rise, tipping scales toward buying by Year 4.